1,11,500 +

Total Transactions

11.8 Billion

Transaction Processed

170 Million

Total Savings

14,000 +

No. of Clients Served

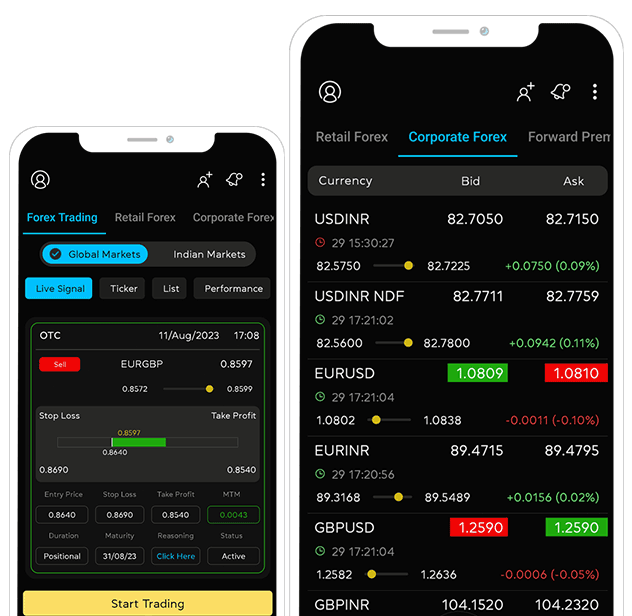

Why Choose Myforexeye?

Our approach is client-focused, tech-driven, and complete. We offer custom FX strategies, real-time insights through our app, and 24/7 expert support. From advisory to hedging and trade finance, we’re your one-stop solution for all FX needs. We specialize in helping businesses navigate the complexities of forex markets by providing customized solutions that align with your unique financial goals.

Services We Offer

Forex Risk Management

Our in-house experts provide tailored forex risk management, including hedging strategies, exposure management, and real-time market insights.

Transaction Process Outsourcing

Myforexeye’s TPO service helps corporates and HNIs reduce forex transaction costs with transparency and affordability.

Supplier’s Credit

A loan allowing Indian importers to pay for goods later, using an Letter of Credit (LC) from an Indian bank for low-interest short-term funding.

Buyers credit

A loan arranged through a foreign bank with an Standby Letter of Credit (SBLC) from an Indian bank, allowing importers to repay later.

Export LC Discounting

Exporters can get early payment on export bills under an Letter of Content (LC), even before the buyer pays.

Export Factoring

Exporters sell invoices at a discount for upfront cash, avoiding delays from foreign buyers.

Deepen Your Forex Intelligence

Unlock expert insights, real-world strategies, and practical tips to help your business manage forex risk, optimize treasury operations, and improve financial outcomes.

Testimonials from satisfied customers

Hear What Sets Us Apart

Buying foreign currency with Myforexeye, there’s one thing I’m sure of that I can’t go back to doing it any other way or any other place."They are the best"

We have been using the services of Myforexeye for the last 2 years. Their currency market predictions and analysis are mostly accurate

The Myforexeye Client Journey

Discovery & Diagnostics

We analyze your FX challenges to identify risks and inefficiencies, laying the foundation for tailored solutions.

Tailored Solution Design

We craft a strategy to optimize costs, manage FX risks, and align with your cash flow, supported by real-time tracking.

Client Presentation & Proposal

We present a data-driven strategy with clear visuals, outlining potential savings and implementation steps.

Client-Specific Benchmarking

We establish benchmarks for savings and performance, tracking the financial impact of our strategy.

Operational Execution

We handle your daily FX operations, ensuring optimal timing and streamlining trade finance processes.

MIS & Monitoring

We provide real-time insights and customized reports to enable informed decision-making.

Periodic Reviews & Optimization

We review performance, optimize strategies, and ensure alignment with your business goals and market changes.

Unlock the secrets of forex risk management, financial optimization, and smarter treasury strategies — with India’s leading experts.

Talk to a Myforexeye Expert

Schedule a free call with our FX specialists. Our team dives deep into your currency challenges—helping you leverage intelligent insights for precision, protection, and performance.

Get in Touch