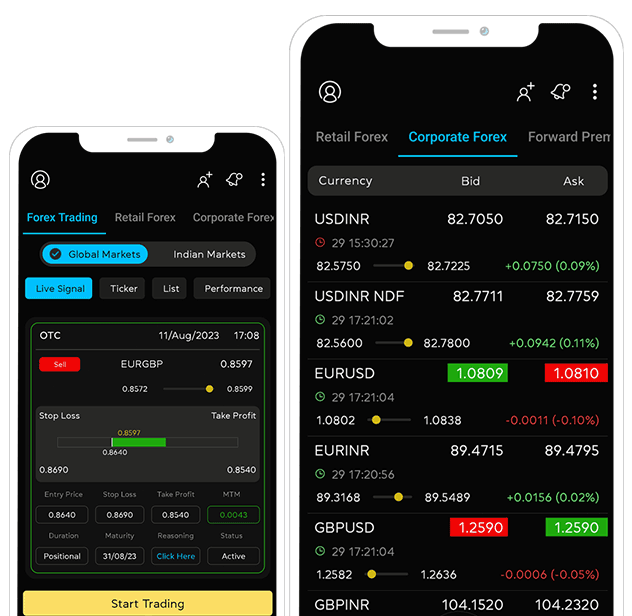

Reduce Forex Costs,

Increase Profits

Myforexeye is helping companies improve profitability by managing bank conversion costs on forex remittances, reducing impact of volatility in forex markets on exports and imports, optimise interest costs on working capital and term loans.

Get in TouchLet's connect!

Why Myforexeye?

How Myforexeye Helps

Companies Improve Profitability:

Optimize Forex Conversion Costs

Manage Forex Volatility Risks

Reduce Interest Costs

Our Clients

Listen To Our Customers

What We Have Achieved Till Now

1,11,500

Total Transactions

$11.8 Billion

Transactions Processed

$170 Million

Total Savings

14,000

No. of Clients Served

Case Studies

Leading Pharmaceutical Manufacturer Global presence, $10–15 million monthly forex exposure.

High bank margins: 20–30 paisa per transaction, leading to increased costs.Solution

Negotiated reduced rates (down to 14 paisa), provided advisory on future negotiations, resulting in significant cost savings.

E-commerce MSME in Bangalore Annual turnover of ₹20 crores, primarily USD transactions.

Unfavorable exchange rates, manual processes causing delays, and poor bank support.Solution

Introduced automated forex platform, optimized rates, and streamlined processes, saving approximately ₹8 lakhs annually.

International Trader Regular dealings in foreign currencies.

Lack of reliable and cost- effective forex solutions.Solution

Provided personalized forex advisory services, leveraging market insights to optimize trading strategies and reduce costs.