Exploring Major Events that Shape the Indian Forex Market

The Indian foreign exchange (forex) market is a dynamic and complex ecosystem that is influenced by a multitude of factors. From economic indicators to geopolitical events, various forces shape the movement of currencies in this market. Traders and investors keenly follow these events as they provide valuable insights into potential market trends. In this blog post, we will delve into some major events that have a significant impact on the Indian forex market.

Economic Indicators

Economic indicators plays significant role on forex trading decisions. Events like the release of Gross Domestic Product (GDP) figures, inflation rates, and trade balances can significantly impact currency values. For instance, if India's GDP growth surpasses expectations, it could strengthen the Indian rupee as it reflects a robust economy. Similarly, higher inflation might lead to currency depreciation as it erodes purchasing power.

Reserve Bank of India (RBI) Decisions

The monetary policy decisions made by the Reserve Bank of India (RBI) are closely watched by traders. Interest rate changes can have a profound impact on currency values. A hike in interest rates could attract foreign investments, thereby strengthening the Indian rupee. Conversely, a rate cut might make the currency less appealing to investors, leading to depreciation.

Geopolitical Events

Geopolitical events such as political instability, conflicts, and international trade disputes can create significant fluctuations in the forex market. These events often lead to uncertainty, causing traders to seek safe-haven currencies like the US dollar, Japanese yen, or Swiss franc. The Indian rupee can weaken during times of global turmoil due to capital outflows.

International Trade Agreements

Trade agreements and partnerships between India and other countries can impact forex trading. Positive trade developments can boost the country's exports and strengthen its currency. On the other hand, trade tensions or disruptions can lead to currency depreciation.

Global Economic Trends

Global economic trends, especially those in major economies like the United States, China, and the European Union, can influence the Indian forex market. Changes in their economic indicators can lead to shifts in investor sentiment and capital flows.

Oil Prices

As a net importer of oil, India's economy is sensitive to fluctuations in oil prices. Higher oil prices can lead to an increased trade deficit, putting pressure on the Indian rupee. Traders often closely monitor oil price movements to anticipate potential impacts on the currency.

Budget Announcements

The annual budget announcement by the Indian government can also affect the forex market. Measures that promote economic growth, fiscal discipline, and infrastructure development can positively influence the currency's value.

Global Interest Rate Trends

Interest rate trends in major global economies can impact the Indian forex market. Higher interest rates in other countries can attract foreign capital, potentially leading to currency appreciation. Conversely, lower rates in major economies might make investments in India more attractive.

Natural Disasters and Climate Events

Natural disasters and climate-related events can impact a country's economy and subsequently its currency. These events can disrupt supply chains, affect agricultural output, and lead to economic uncertainty.

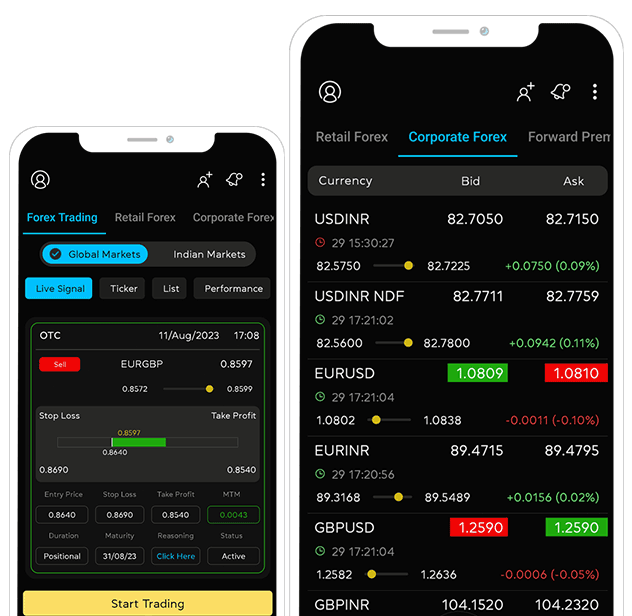

Technological Advancements

In the modern age, technological advancements have made forex trading more accessible and efficient. Algorithmic trading, artificial intelligence, and big data analytics are transforming how traders make decisions. Rapid information dissemination through online platforms also means that market reactions to events can be swift and substantial.

The Indian forex market is influenced by a diverse range of factors, both domestic and international. Traders and investors must stay informed about these major events to make informed decisions and navigate the market effectively. Economic indicators, central bank decisions, geopolitical events, trade agreements, global economic trends, oil prices, budget announcements, interest rate trends, natural disasters, and technological advancements all play a role in shaping the trajectory of the Indian rupee.

Successful forex trading requires a deep understanding of these events, their potential impacts, and the ability to analyze and interpret their significance accurately. As the market continues to evolve, traders who remain vigilant and adaptable in response to these events are more likely to thrive in this intricate landscape. Whether it's a government policy change or a global economic shift, each event contributes to the intricate tapestry that is the Indian forex market.

Anand Tandon

Anand Tandon founded Myforexeye in 2014 with a vision to guide MSMEs through the complexities of foreign exchange risk management. Leveraging over two decades of expertise and an education from the Indian Institute of Foreign Trade, Anand has steered over 4,000 enterprises towards financial success by helping mitigate forex-associated risks. As Myforexeye CEO, Anand collaborates closely with business leaders to formulate customized foreign exchange hedging strategies and provide hands-on support. His past advisory roles with leading financial institutions have honed his proficiency in global financial markets.

Want to manage Forex?

Newsletter signup

Receive forex updates right in your mail box