Decoding Finance Cost

Make smart choices to reduces borrowing cost in a dynamic global market environment

What is Pre-Shipment credit?

Pre-shipment credit is a short-term loan provided by banks and financial institutions to enterprises to help fund the acquisition and shipping of products or services for export.

Pre-shipment Credit in Rupee:

Exporters can avail credit in rupee before! shipment of goods.

Pre-shipment Credit in Foreign Currency (PCFC):

Exporters can also avail credit in foreign currency before shipment of goods

Export Bills Purchased/Discounted

Exporters can get their export bills purchased or discounted on a Documents against Acceptance (DA) or Documents against Payment (DP) basis.

Export Bills Negotiated

Exporters can get their export bills negotiated under a Letter of Credit (LC).

Advance against Bills Sent on Collection Basis:

Exporters can avail advance against bills sent on collection basis.

Post-Shipment Credit in Rupee:

Exporters can avail credit in rupee after shipment of goods.

Post-Shipment Credit in Foreign Currency:

Exporters can also avail credit in foreign currency after shipment of goods.

Why it is beneficial?

Pre-shipment credit improved cash flow by financing goods or services for export, helping financial resource management and mitigating financial risks for businesses.

Importantly, if pre-shipment credit is in a foreign currency, post-shipment credit must also be in the same curren- cy, offering exporters cost advantages linked to LIBOR/EURIBOR rates.

Understanding export incentives is important when evaluating funding options for exporters

Buyer’s Credit

Buyer's credit is a financing option available to importers in India. It is a short term working capital trade credit loan extended to an importer by an overseas lender such as a bank or financial institution. This facility enables importers to procure loans from overseas financial institutions at lowcost borrowing rates, which are coupled with SOFR rates. It is important for importers to consult with financial experts and adhere to relevant regulations when considering raising debt through buyer's credit. The calculator helps you evaluate the arbitrage available between rupee and foreign currency funding options.

Supplier’s Credit

Supplier's credit is a financing option available to importers in India. It is a structure of financing import into India where overseas suppliers or financial institutions outside India provide financing to the importer on LIBOR-linked rates against a usance letter of credit (LC). This facility enables importers to procure loans from overseas financial institutions at lowcost borrowing rates, which are coupled with LIBOR rates⁵. It is important for importers to consult with financial experts and adhere to relevant regulations when considering raising debt through supplier's credit. The calculator helps you evaluate the arbitrage available between rupee and foreign currency funding options.

Tenor

| Range | Pricing Range | ||

|---|---|---|---|

|

From |

To |

Lower | Higher |

A domestic company can raise debt in foreign currency through the FCNR(B) route despite having no exports or imports. FCNR(B) loans are disbursed and repaid in foreign currency at fixed interest rates, usually lower than domestic rates. However, RBI regulations like the Master Directions on ECBs apply. Companies should consult financial experts and follow relevant guidelines when raising foreign currency debt.

When financing a Greenfield project, compare borrowing costs of local versus foreign currency loans. Foreign loans can have lower rates but pose exchange rate risk. Local loans eliminate this risk but could have higher rates. Also examine machinery procurement - localized purchas- es reduce transportation costs, yet imports provide advanced technolo- gy. To select the best finance approach, carefully balance the potential cost savings and risks of all financing and sourcing choices against the project's specific needs.

Pre-sanction stage advisory

Myforexeye helps businesses get good loan terms from lenders, reducing borrowing costs. Carefully examining each cost item assists in finding the best funding option.

Post-Sanction implementation

After a project is approved, closely check the sanction letter limits on what loans are allowed. If foreign cur- rency loans can be used, Myforexeye can help get the money and manage risks of interest and currency changes.

Frequently Asked Questions

What Clients Says

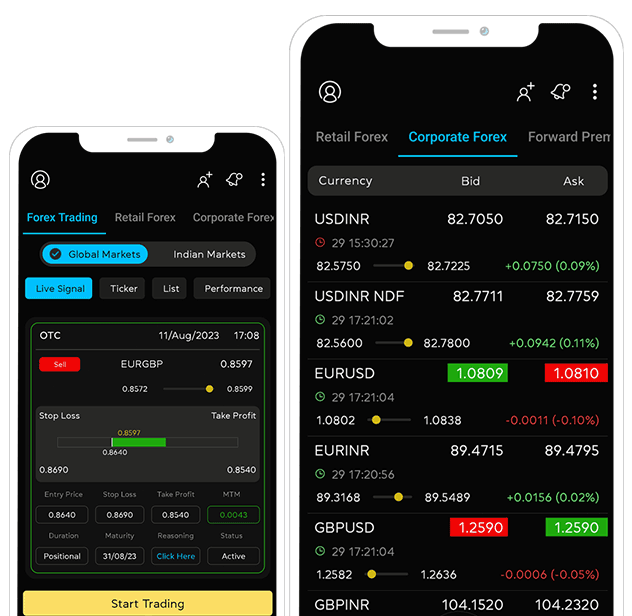

Buying foreign currency with Myforexeye, there’s one thing I’m sure of that I can’t go back to doing it any other way or any other place."They are the best"

We have been using the services of Myforexeye for the last 2 years. Their currency market predictions and analysis are mostly accurate

We have been using the services of Myforexeye for the last 2 years. Their currency market predictions and analysis are mostly accurate

My experience with them has been nothing short of exceptional. If you're in search of reliable and efficient forex services, Myforexeye is the perfect choice

I highly recommend Myforexeye for their exceptional services. My experience with Myforexeye has been excellent, and I trust their services for all my forex-related needs. If you are looking for reliable and efficient forex services, Myforexeye is the way to go.

Case Studies

What We Have Achieved Till Now

Total Transactions

Transactions Processed

Total Savings

No. of Clients Served