Sortino vs. Sharpe Ratio

The art of making informed investment decisions involves a delicate balance between risk and reward. Investors constantly seek ways to gauge the performance of their portfolios, and that's where performance metrics like the Sortino and Sharpe ratios come into play. These ratios serve as valuable tools to assess an investment's risk-adjusted returns, shedding light on the intricate dance between gains and potential losses.

Understanding the Sharpe Ratio

The Sharpe ratio, developed by Nobel laureate William F. Sharpe, has been a staple in investment analysis since 1960s. This ratio measures the excess return of an investment (or portfolio) per unit of its volatility, or standard deviation. In simpler terms, the Sharpe ratio quantifies the compensation an investor receives for taking on additional risk. A higher Sharpe ratio indicates a better risk-adjusted performance, as the investment is generating higher returns relative to its volatility.

Mathematically, the Sharpe ratio can be calculated using the formula:

Sharpe Ratio = Return of portfolio – Risk free rate / Standard deviation

Where:

- Return of portfolio is the historical performance of the fund for which you are computing the Sharpe Ratio? Returns can span any time frame, though opting for a long-term period is generally advisable.

- Risk-free rate of return, which can encompass various options such as the 365-day Treasury bill yield or the State Bank of India's fixed deposit return.

- Standard deviation, indicating the volatility or variations in its returns during the given period. Increased fluctuations signify elevated risk levels.

A higher Sharpe Ratio indicates that the investment has generated higher returns for the level of risk taken. Investors often use the Sharpe Ratio to compare different investment options and determine which one offers a better risk-adjusted return. However, one limitation of the Sharpe Ratio is that it considers both upside and downside volatility equally, which might not align with the preferences of all

Sortino Ratio

The Sortino Ratio, developed by Frank A. Sortino, addresses one of the limitations of the Sharpe Ratio by focusing specifically on downside risk. While the Sharpe Ratio considers all volatility, the Sortino Ratio only takes into account the volatility associated with negative returns. This makes it particularly relevant for risk-averse investors who are more concerned about minimizing losses.

The formula for calculating the Sortino ratio is as follows:

Sortino ratio = Average asset return – Risk Free rate / Standard Deviation of downside risk

Where:

- Average asset return: Portfolio's performance, whether assessed through historical outcomes (actual results) or expected returns.

- Risk free rate: The money you make without any risk of financial loss like through mutual funds or government securities.

- Standard deviation of downside risk: exclusively evaluates negative returns, with positive values in the historical returns replaced by 0.

Comparing Sortino and Sharpe Ratios

Both the Sharpe Ratio and the Sortino Ratio provide valuable insights into risk-adjusted performance, but they have distinct characteristics that make them suitable for different situations.

The Sharpe Ratio provides a balanced view of risk and return, making it suitable for investors who are willing to tolerate a certain level of risk to achieve higher returns. It's particularly useful when comparing investments with similar return levels but varying levels of volatility. However, the Sharpe Ratio might not be the best choice for risk-averse investors who are more concerned about limiting potential losses.

On the other hand, the Sortino Ratio is tailor-made for risk-averse investors. By focusing solely on downside volatility, it aligns more closely with the mindset of those who prioritize capital preservation. This metric is especially useful when evaluating investments in volatile markets or for strategies where minimizing losses is a priority.

In essence, the choice between the Sortino and Sharpe ratios depends on the investor's objectives and risk preferences. A higher Sharpe ratio suggests efficient risk-adjusted returns overall, while a higher Sortino ratio highlights better performance in managing downside risk.

How Myforexeye can help you in Understanding Sortino & Sharpe Ratios?

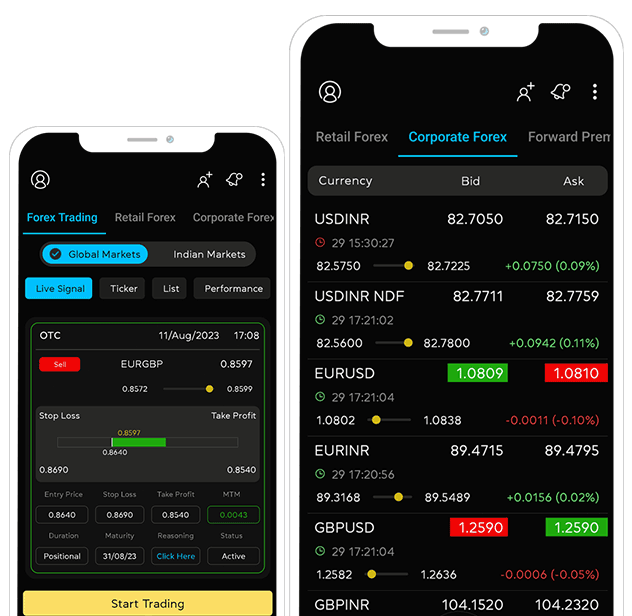

If you're intrigued by the intricacies of evaluating risk and reward through metrics like the Sortino and Sharpe ratios, Myforexeye offers a wealth of knowledge and resources to deepen your understanding. Myforexeye is a renowned platform that provides comprehensive insights and guidance in the realm of forex and treasury risk management. With a team of seasoned experts and industry professionals, Myforexeye not only helps you grasp the nuances of risk assessment but also equips you with the tools to make informed investment decisions.

As part of their educational initiatives, Myforexeye offers in-depth learning modules and workshops, including insightful discussions on metrics like the Sortino and Sharpe ratios. By joining the Myforexeye community, you gain access to a network of like-minded individuals eager to expand their financial acumen.

For investors seeking a comprehensive view of risk and return, the Sharpe Ratio is a suitable choice. However, for those who prioritize protecting their investments from significant losses, the Sortino Ratio provides a more focused assessment of downside risk. Ultimately, understanding the differences and applications of these two ratios empowers investors to choose the metric that best aligns with their investment philosophy and objectives.

As you embark on your journey to master the art of investment assessment, consider partnering with Myforexeye to unlock a world of insights and expertise. If you're eager to delve deeper into the world of Sortino and Sharpe ratios, there's no better time than now to join the Myforexeye community. Your path to informed investment decisions starts here.

Anand Tandon

Anand Tandon founded Myforexeye in 2014 with a vision to guide MSMEs through the complexities of foreign exchange risk management. Leveraging over two decades of expertise and an education from the Indian Institute of Foreign Trade, Anand has steered over 4,000 enterprises towards financial success by helping mitigate forex-associated risks. As Myforexeye CEO, Anand collaborates closely with business leaders to formulate customized foreign exchange hedging strategies and provide hands-on support. His past advisory roles with leading financial institutions have honed his proficiency in global financial markets.

Want to manage Forex?

Newsletter signup

Receive forex updates right in your mail box