Understanding Pre-Shipment Credit in Foreign Currency

In international trade and export financing, Pre-Shipment Credit in Foreign Currency (PCFC) plays a pivotal role. This financial instrument, also known as packing credit, offers exporters the vital working capital they need before shipping their goods to foreign buyers. In this comprehensive guide, we delve into the intricacies of PCFC, exploring the key players, operational guidelines, required documents, credit currency options, and the benefits it offers to businesses operating on a global scale.

Key Players in Pre-Shipment Credit

- Exporters: Exporters are the primary beneficiaries of pre-shipment credit. They rely on this financial facility to cover various costs, including production, packaging, and transportation, ensuring a seamless export process.

- Export Credit Agencies: Government agencies and specialized institutions often play a significant role in facilitating pre-shipment credit. They may provide insurance or guarantees to lenders, mitigating the risks associated with export financing.

- Banks and Financial Institutions: Banks and financial institutions are the cornerstone providers of pre-shipment credit. They meticulously assess the creditworthiness of exporters and extend the necessary funding to support the smooth flow of goods in international trade.

Overview of Pre-Shipment Credit

A bank can offer an advance on the required amount, known as pre-shipment credit, for activities related to export and import. This credit is provided to an exporter based on the Letter of Credit issued in the exporter's name or by a person closely associated with the exporter's business. The Letter of Credit must be released by an overseas buyer or as an irrevocable or confirmed order for the export of goods from India. Any form of evidence indicating an order for shipping is accepted as a Letter of Credit by the bank.

Exporters in India have two primary options:

- Avail pre-shipment credit in foreign currency and reduce export bills in foreign currency at the post-shipment stage.

- Obtain finance for export at a pre-shipment stage in Indian Rupees. Post-shipment credit can be settled in Indian Rupees or a preferred foreign currency.

Authorised dealers can provide exporters with Pre-shipment Credit in Foreign Currency (PCFC) for local and imported inputs to exported goods. The pre-shipment credit is offered at LIBOR/EURO or LIBOR/EURIBOR-related interest rates to make this line of credit available to exporters at internationally competitive prices.

Credit Currency Options

The Reserve Bank of India allows pre-shipment credit to be offered in convertible currencies. Currently, Pre-shipment Credit in Foreign Currency is provided in U.S. Dollars, EURO, and GBP, subject to fund availability. This flexibility enables exporters to receive PCFC in a convertible currency, regardless of the currency in which the export order is invoiced. However, this approach involves the risk and cost of cross-currency transactions for the exporter.

For instance, an exporter may choose to avail PCFC in Euros against an export order initially invoiced in U.S. Dollars. In such cases, the exporter bears the costs and risks associated with cross-currency transactions. Foreign currency pre-shipment is also made available to exporters from member countries within the Asian Clearing Union.

Operational Guidelines

Exporters can access Pre-shipment Credit in Foreign Currency (PCFC) conveniently at 'A' category branches and designated 'B' category branches of a bank for convenience. 'C' category branches are not permitted to manage the PCFC facility in their books; all PCFC transactions must be routed through a designated 'B' or 'A' category branch. 'C' category branches are required to maintain a dummy ledger account for drawn and adjusted amounts, reporting them in the W-1 statement to the Regional Officer.

Several aspects are considered when an authorized bank branch evaluates a PCFC request:

- Pre-shipment Credit in Foreign Currency is extended to Standard Accounts.

- Exporters requesting PCFC must have a good record of conducting export operations.

- Exceptions for liquidating pre-shipment credit should be made only for compelling reasons.

- Export accounts must not remain overdue, except in genuine cases.

- PCFC may be granted to deemed exporters for supplies to projects funded by multilateral/bilateral agencies/funds. At a post-shipment stage, the distinction is limited to 30 days or until payment by the authorities, whichever is earlier.

- Scrutiny of the contract and Letter of Credit details is essential.

- Breakdown of remittance amounts against import bills and those to be converted into Indian Rupees is examined.

Documents Required

To approve PCFC in the name of a specific exporter, a bank branch must obtain the necessary documents. The branch should receive a request letter from the exporter's customer, in the prescribed format mentioned in Annexure 5(1). Security documents required for Rupee Packing Credit should also be submitted, and a Demand Promissory Note in the required Foreign Currency is essential.

Credit Limits

Export Limits (P.C. and FDB) are sanctioned in both Indian Currency and Foreign Currency. The assessment in Indian Currency is based on a working capital cycle, including pre-shipment and post-shipment activities, while the Foreign Currency assessment is determined based on the latest FEDAI rate. Outstanding PCFC/FDBD amounts are controlled in Foreign Currency.

Period of Credit

Pre-shipment Credit in Foreign Currency, in the case of Indian Rupees, is initially available for a specific period, determined by the sanctioning authority based on various factors. A maximum period of 180 days is permitted, with the branch monitoring the end use of Rupee credit to ensure it is not diverted for other domestic purposes.

Rate of Interest

The interest rate on PCFC is influenced by the existing LIBOR/EURO or LIBOR/EURIBOR rates at the time of advance, along with the sanctioned spread. These rates are available for various durations. B-category branches disburse PCFC at a rate obtained from the Treasury Branch in Mumbai. Interest is charged at the rate fixed at the time of disbursal, and it remains constant for earlier outstanding loans. If a bank avails a line of credit from a foreign bank to fund PCFC, the withholding tax must be passed on to the exporter.

The Process of Obtaining Pre-Shipment Credit

The pre-shipment finance application process differs between banks and pre-shipment finance type, but the overall workflow is generally as follows:

- Application: Exporters interested in pre-shipment credit apply to a bank or financial institution, providing detailed information about the export transaction, including the confirmed order, nature of goods, and the required credit amount.

- Documentation: The lender evaluates the exporter's application and reviews all necessary documentation, including export orders, invoices, and other relevant paperwork. The creditworthiness and track record of the exporter are also considered.

- Credit Approval: If the lender approves the application, they specify the credit amount, interest rate, and repayment terms. The credit may be offered as a loan or a line of credit.

- Utilization: The exporter uses the approved credit to cover pre-shipment expenses, including raw materials, labor, and packaging.

- Export Shipment: Once the goods are ready for export, they are shipped to the foreign buyer. The proceeds from the sale are used to repay the pre-shipment credit.

- Repayment: The exporter repays the credit, including interest, using the proceeds from the export sale, based on the terms determined during the credit approval process.

Expiry of Contracts/Letters

The head of a bank branch can approve pre-shipment finance (PCFC) extensions up to 180 days if the exporter requests it in writing and the underlying Letter of Credit or order remains valid. The exporter must pay any additional bank costs from the extension, but will not receive any profits.

With Regional Office approval, the bank can grant an extension from 180 days up to 270 days if the export contract or Letter of Credit stays valid for the prolonged period. Under certain circumstances, an extension beyond 270 days up to a maximum 360 days may be approved after getting consent from the Regional Office, provided the export contract or Letter of Credit allows shipment during the extended timeframe. The interest rate on PCFC beyond 180 days will be the current rate plus an extra 2 percent.

If no export occurs within 360 days, the PCFC must be adjusted at the TT selling rate on the date of liquidation, with interest recovered on the Rupee equivalent of the principal at the Packing Credit rate plus 0.125 percent commission.

When an export order is cancelled, the PCFC should be liquidated by selling the equivalent foreign exchange at the prevailing TT selling rate and recovering interest.

The bank must ensure the reason for adjusting the PCFC with Rupee funds is genuine. Rupee Packing Credit will not be granted again for such export orders.

Benefits of Pre-Shipment Credit in Foreign Currency

- Smooth Business Operations: Pre-shipment credit ensures exporters have the funds required for seamless production and packaging, meeting delivery schedules and maintaining positive business relationships.

- Competitive Advantage: Exporters can secure larger orders and compete effectively in international markets by offering attractive payment terms to foreign buyers.

- Risk Mitigation: Pre-shipment credit reduces the risk of non-payment, as it's tied to specific export transactions, providing protection against new or unknown buyers.

- Working Capital Management: Businesses can manage their working capital more effectively, freeing up funds for other essential operations and investments.

- Currency Management: Providing pre-shipment credit in foreign currency helps exporters hedge against currency fluctuations and avoid exchange rate risks.

- Support for SMEs: Pre-shipment credit is a lifeline for small and medium-sized enterprises looking to enter the international market, enabling them to compete globally.

Challenges and Considerations

While pre-shipment credit in foreign currency offers numerous benefits, several challenges and considerations should be noted:

- Interest Costs: Exporters are responsible for the cost of interest on pre-shipment credit, which can impact profit margins.

- Exchange Rate Fluctuations: Monitoring exchange rates is crucial when dealing in foreign currency to minimize the impact of adverse movements on revenue.

- Documentation and Compliance: International trade means dealing with a lot of paperwork and following the rules. Exporters need to make sure they do everything the law requires.

- Creditworthiness: The ability to obtain pre-shipment credit depends on the exporter's creditworthiness, which may be a challenge for new or less-established businesses.

- Repayment Risks: In some cases, export sales may not go as planned, leading to repayment challenges. Export credit insurance can help mitigate this risk.

Conclusion

Ultimately, pre-shipment credit is an ideal funding option for exporters across India. Pre-shipment credit allows exporters to have adequate financing so that they can concentrate on bettering their export activities and increase their profits. Additionally, availing finance for exports in Indian Rupees or in foreign currencies allows exporters to reap greater returns from their operations. Similarly, authorised dealers can provide exporters with pre-shipment credit in foreign currency for local and imported inputs to exported goods at internationally competitive prices. Therefore, companies must assess the entire landscape of pre-shipment credits available to them and consider using one of these credit facilities for successful export operations.

Anand Tandon

Anand Tandon founded Myforexeye in 2014 with a vision to guide MSMEs through the complexities of foreign exchange risk management. Leveraging over two decades of expertise and an education from the Indian Institute of Foreign Trade, Anand has steered over 4,000 enterprises towards financial success by helping mitigate forex-associated risks. As Myforexeye CEO, Anand collaborates closely with business leaders to formulate customized foreign exchange hedging strategies and provide hands-on support. His past advisory roles with leading financial institutions have honed his proficiency in global financial markets.

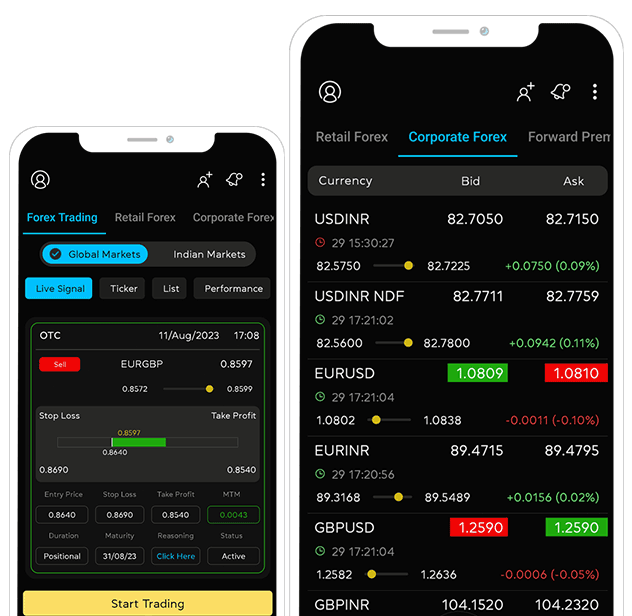

Want to manage Forex?

Newsletter signup

Receive forex updates right in your mail box