Interest Cost Optimization

Reduce working capital finance cost with our domestic and global currency interest rate evaluation

An introduction to Interest cost optimization strategy

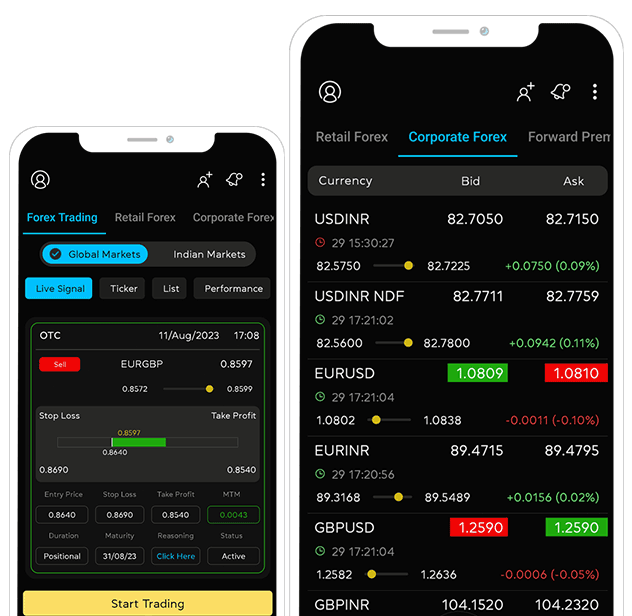

Myforexeye interest optimization offering is an innovative multi-dimensional, multi-currency liquidity solution that allows corporates’ to reduce cost of borrowing on their entire borrowings across geographies and usage.

Improved financial performance

Reducing interest costs can improve the company's bottom line and increase profitability.

Increased competitiveness

Lower interest costs can give the company a competitive advantage by reducing its overall cost structure.

Enhanced flexibility

By reducing interest costs, the company may have more financial flexibility to invest in growth opportunities or weather economic downturns.

Better risk management

Evaluating interest cost optimization strategies can help the company better manage its financial risks and reduce its exposure to interest rate fluctuations.

Improved decision making

A thorough evaluation of interest cost optimization strategies can provide valuable insights and inform better decision making.

From exporters to importers to domestic companies to multi-national companies and just about anything in between can use our services to objectively reduce borrowing costs on working capital finance and long term loans.

Multi-dimensional Strategy

Myforexeye supports customers across a wide range of industries, traders operating domestically or moving goods and capital across the globe and beyond. Explore more with our experts.

| Multi-Dimensional Product Evaluation Strategy | ||||

|---|---|---|---|---|

| Borrowing Options | Company | |||

| Debt Form | Product Type | Domestic Sales | Global Sales / Purchases | |

| Term Debt | Term Loans / ECB / FCTL | Local Currency | Multi-currency | |

| Working Capital | Pre-shipment | Local Currency | Multi-currency | |

| Post-shipment | Local Currency | Multi-currency | ||

| Fund-Based | Cash Credit/WCDL/FCNR (B) | EPC/PCFC, | ||

| Non-fund based | LCBD | Buyer's or Supplier's Credit | ||

Advantages of Interest cost optimization strategy

Salient Features

Creating Value

Cost optimization should be about just reducing costs, but about optimizing them in a way that creates value for business

Future State

Cost optimization initiatives should be based on the desired future state of the business, rather than on a historical model with irrelevant data.

Transformational perspective

Cost Optimization us not just about cost-cutting, but about changing processes and driving efficiencies through continuous improvement

FINANCE STRUCTURING MADE SIMPLE

Exporters: Pre & Post Shipment Finance

Finance that moves with your exports

From working capital before shipment to faster realization after

shipment—choose rupee or foreign-currency credit, tap government

incentives, and align pre & post shipment finance for smarter cost

savings.

Importers: Buyer’s & Supplier’s Credit

Lower global borrowing, smarter imports

Access overseas funding linked to global benchmarks like SOFR or

LIBOR. Compare rupee vs foreign-currency options and reduce your

import finance cost with expert advisory.

Domestic Companies: Foreign Currency Loans

Think global, even without exports

Domestic businesses can tap FCNR(B), ECBs, or FCTL loans at lower international rates. Structure debt strategically under RBI guidelines to unlock cost efficiency.

Greenfield Projects: Local vs Foreign Funding

Build smart from day one

Balance local vs foreign borrowing costs, weigh exchange-rate risks,

and make better sourcing choices—local machinery vs imported tech—to

create the right financial structure for new projects.

Frequently Asked Questions

What Clients Says

We are associated with Myforexeye since 2014, they have been consulting us on our forex exposures and also reforming our hedging strategies. They have been looking after our treasury managemnt effeciently.

We have large dollar exports and managing forex risk is critical for our overall business profitability. We have collaborated with Myforexeye for forex market intelligence and insights to take prudent and informed decisions.

Myforexeye significantly reduced our trade finance costs to less than half of our previous bank payments, demonstrating their effectiveness in optimizing financial strategies and expenses.

We have been using the services of Myforexeye for the last 2 years. Their currency market predictions and analysis are mostly accurate.

My experience with them has been nothing short of exceptional. If you're in search of reliable and efficient forex services. Myforexeye is the perfect choice.

Case Studies

What We Have Achieved Till Now

Total Transactions

Transactions Processed

Total Savings

No. of Clients Served