Forex Risk Management

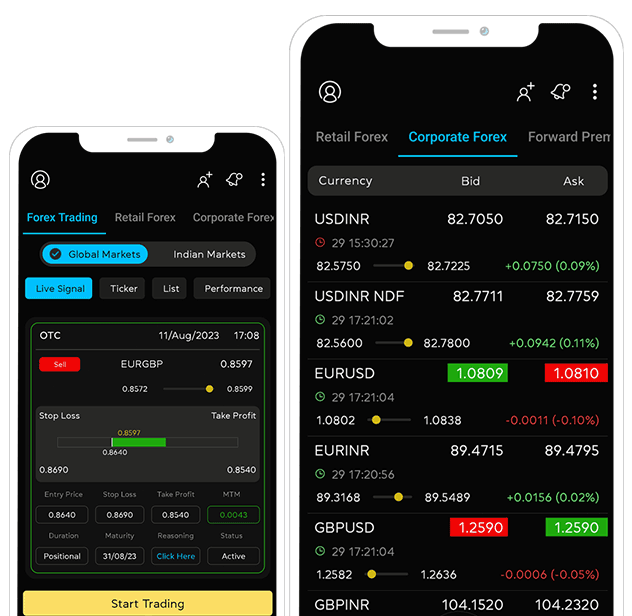

Myforexeye helps in quantifying and hedging forex risk.Forex Management Updates at Your Finger Tips, Stay Informed on Mobile App.

Why do you need Foreign Exchange Market and Risk

Management?

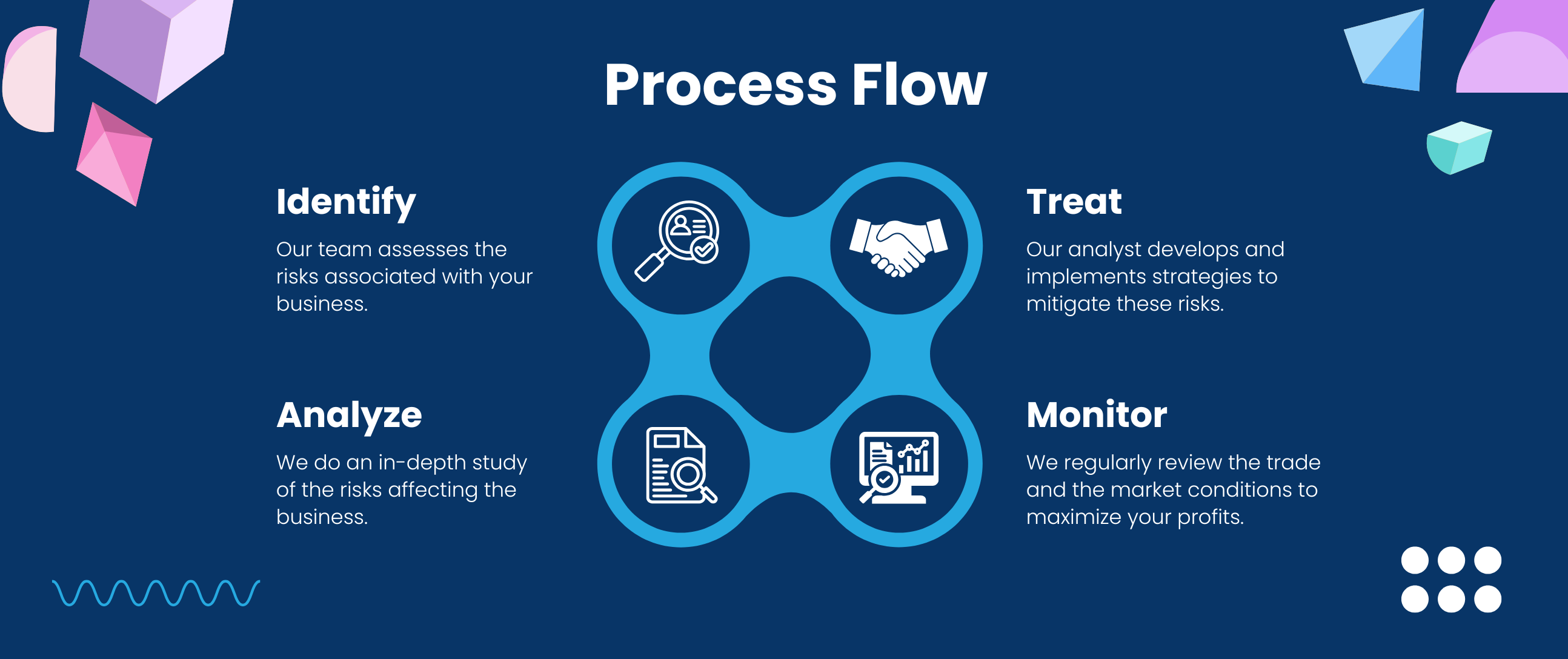

Importers and exporters face a range of risks when engaging in

foreign currency transactions. Effective Forex risk management can

help mitigate those risks and ensure that transactions are

profitable and sustainable. By adopting best practices in Forex

risk management, importers and exporters can manage their exposure

to Forex risk effectively, comply with regulatory requirements and

enhance their overall business performance. This is why you need

Myforexeye foreign currency risk management services to back you

up. With us, you get

Fx Risk management solutions which are customized made to suit your risk appetite.

Allows you to set goals for hedging forex risk.

Easily measure performance of the hedged or unhedged positions in accordance to your goals.

Protect your budgeted revenues and expenditures.

Safeguard your profit margins by hedging forex risk.

Increase competitiveness.

FX risk management is key

to ensure the financial health of your company

Advantages of Foreign Currency Risk Management:

Better prediction of cash flow

Reduce currency risk

Avoid paying excessive transaction costs

Boost your company's financial performance.

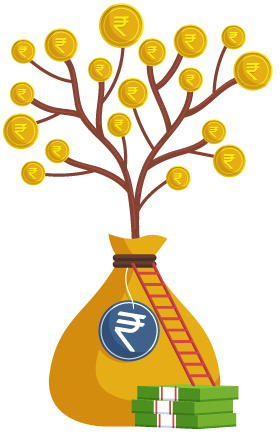

Mature Forex Risk Management Framework

-

Benchmarking exposures

Benchmarking exposures

-

Risk Mitigation

Risk Mitigation

-

Stability of P&L account

Stability of P&L account

-

Data driven approach

Data driven approach

-

Trying to catch high and lows

Trying to catch high and lows

-

Juggle between greed and fear

Juggle between greed and fear

-

Volatility in P&L

Volatility in P&L

-

Assumption based approach

Assumption based approach

Exporters feel USD is always is an uptrend & there is no need to hedge forex risk using forwards

It's a myth or a reality?

20 years data suggest otherwise

Download Report

Micro manage Forex Exposure Improve treasury performance by 25 to 50 paisa per dollar?

Book your complimentary forex risk management consultation today with our experienced advisors

Book An AppointmentSalient Features

How to measure performance of your fx hedging Operations? Accounting entries doesn’t really gives 360 view of the real fx hedging performance

What Clients Says

We are associated with Myforexeye since 2014, they have been consulting us on our forex exposures and also reforming our hedging strategies. They have been looking after our treasury managemnt effeciently.

We have large dollar exports and managing forex risk is critical for our overall business profitability. We have collaborated with Myforexeye for forex market intelligence and insights to take prudent and informed decisions.

Myforexeye significantly reduced our trade finance costs to less than half of our previous bank payments, demonstrating their effectiveness in optimizing financial strategies and expenses.

We have been using the services of Myforexeye for the last 2 years. Their currency market predictions and analysis are mostly accurate.

My experience with them has been nothing short of exceptional. If you're in search of reliable and efficient forex services. Myforexeye is the perfect choice.

Case Studies

What We Have Achieved Till Now

Total Transactions

Transactions Processed

Total Savings

No. of Clients Served