The Forex Fallacy: Why You’re Losing Money Before the Market Even Moves

The market turned against us.” Sound familiar? For most businesses, forex losses are blamed on market volatility. But here's a brutal truth: the biggest hits aren’t taken when currencies move—they’re taken when you don’t move fast or smart enough. Whether you’re an exporter watching receivables shrink due to a rupee surge, or an importer getting blindsided by a sudden dollar rally—chances are, the damage began long before the market moved. The real problem? Strategy execution, not strategy design.

Cost Centre or Profit Centre? The Strategic Identity Crisis

Too many finance leaders still manage forex as a back-office cost centre—just another overhead to minimise. But in a world where currency fluctuations can swing EBITDA by several points, treating forex as a strategic lever is no longer optional.

The key question here is:

Is your hedging strategy based on market dynamics or on internal benchmarks rooted in business fundamentals? Companies relying solely on external market sentiment often hedge reactively, missing the bigger picture. Instead, aligning hedging with pre-defined business benchmarks—like target margin thresholds or procurement cycles—ensures protection with purpose. If you don’t define success internally, you’re always reacting to the market instead of controlling your exposure.

For Example,

An auto parts exporter receives a $400,000 order. To keep a 12% profit, they need to get at least ₹88.95 per dollar.

On the day the order comes in, the spot rate is ₹88.50, and the 90-day forward premium is ₹0.45.

That means he can lock in ₹88.95 with a forward contract—right on target.

But he waits, hoping for a better rate like ₹89.50. After a few weeks, the forward rate drops to ₹88.45, and he finally hedges.

Now he’s lost ₹0.50 per dollar × $400,000 = ₹2,00,000.

All because he didn’t act when the right rate was available. If he had set and followed the business benchmark, you would have saved that money.

Cash Flow vs. Financing Instruments: Are They in Sync?

It’s astonishing how often a company’s financing instruments are out of sync with its cash flow realities. A mismatch here creates massive strain.

Let’s say you’re an exporter who will receive $100,000 in 90 days from your overseas customer.

But you also have an import payment due in 60 days, and to pay for it, you take a buyer’s credit loan.

Now you have to repay the bank 30 days before you get your export money. That means:

You either need to arrange extra funds for a month,

Or you might be forced to convert forex early at a bad rate.

If the exchange rate was ₹87 when you took the loan, but drops to ₹86.20 at repayment, you lose ₹0.80 per dollar.

Loss = ₹0.80 × $100,000 = ₹80,000

All because your payment and loan cycles didn’t match.

The solution? Align your hedge and financing periods with your real cash flow. If your money comes in after 90 days, take a 90-day loan, not 60. That way, you don’t lose money trying to fill the gap.

The Hidden Cost of Conversions: Are Banks Quietly Over-Charging You?

Banks don't always charge fees in ways that appear on your statements. That 2–3 paise spread they slip into your FX conversion rate? That’s margin leakage. Multiply that by millions in exposure, and you’re losing far more than you think.

A lack of transparency in pricing—especially in forward contracts and cross-currency conversions—means companies unknowingly overpay. Worse, many don’t benchmark FX performance at all. If you’re not tracking the difference between your achieved rate and what the market offered, you’re blind to avoidable losses.

Suppose you're an importer converting $1,000,000 and your bank gives you a rate of ₹86.40, while the real interbank market rate is ₹86.60.

That’s a hidden margin of ₹0.20 per dollar.

Loss = ₹0.20 × 1,000,000 = ₹2,00,000

Now imagine doing this every month.

In a year, you could lose ₹24,00,000—just from this small hidden charge.

And most businesses don’t even realize it because they don’t track or compare what rate they got versus the actual market rate.

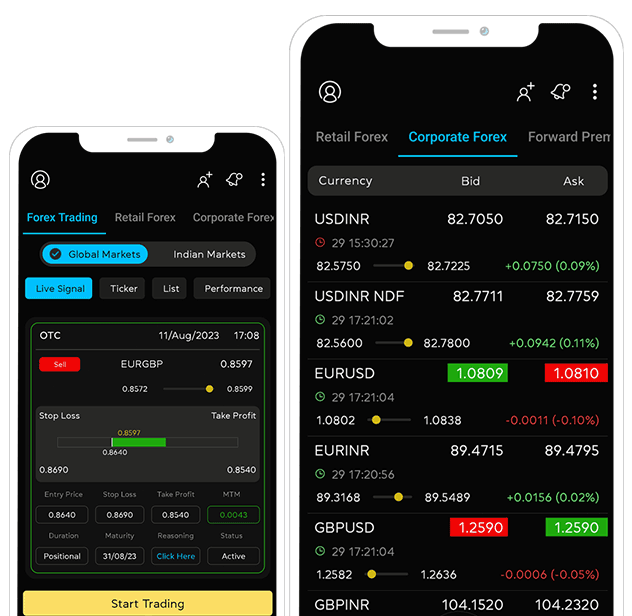

A simple fix? Use platforms like Myforexeye’s App to see live interbank rates. This way, you know exactly what the fair rate is before making a deal, and avoid paying more than you should.

Time to Flip the Script

While it may seem tempting to blame market volatility or external factors for forex losses, the truth is that poor execution and internal inefficiencies often play a much larger role. By treating forex as a controllable lever and shifting towards a strategy-first mindset, businesses can not only mitigate risks but also capitalise on opportunities in ways that previously seemed impossible.

Conclusion: Start Mastering Forex

To truly succeed in the forex market, businesses need to prioritize process improvement, real-time execution, and strategic alignment across all departments. Only then can forex risk management be transformed from a business burden into a growth enabler.

Your forex desk can’t be an afterthought. With the right strategy, FX can be a profit driver—not a leak in your P&L. The mindset shift is simple: stop reacting to the market. Start mastering it.

FAQ (Frequently Asked Questions)

1. How can I minimize the risk of delayed decisions in my forex strategy?

To minimize delayed decisions, implement real-time forex management tools that offer immediate notifications and decision-support features. Automating alerts based on specific thresholds can help businesses act quickly when market conditions change.

2. What’s the best way to align my hedging strategy with business goals?

Ensure your hedging strategy is closely tied to your business’s cash flow cycles and financial objectives. Regularly review your trade finance, payment cycles, and currency exposures to determine the most effective hedging instruments and timings.

3. How do I create a benchmark to measure the success of my forex strategy?

Start by identifying key performance indicators (KPIs) that align with your business objectives. These could include metrics like cost savings from forex conversions, hedging performance, and the reduction in forex-related losses. Regularly compare your actual results against these benchmarks to fine-tune your strategy.

4. Can poor execution of forex strategies affect a company’s overall financial health?

Yes, poor execution can lead to missed opportunities, unnecessary costs, and unhedged risks, all of which can erode profitability and hinder financial growth. By improving forex execution and aligning strategies, businesses can significantly enhance their financial health.