The Hidden Cost of Doing Nothing: How Ignoring Forex Strategy Can Erode Business Margins

In an increasingly global marketplace, foreign exchange is no longer a peripheral concern—it’s central to profitability. Yet, many businesses, especially in trade-intensive sectors like automotive, chemicals, textiles, and machinery, continue to treat forex management as a back-office function. This passive approach has a hidden cost. Over time, the impact of currency volatility, opaque bank charges, and reactive conversions quietly erode margins and impair growth. Ignoring a strategic forex strategy is not just risky—it’s expensive.

Forex as a Back-Office Task: A Costly Mindset

A surprising number of companies still manage their forex exposure through sporadic interventions—often relying on banks for last-minute conversions or treating currency fluctuations as mere accounting line items. This outdated model means:

- No visibility into real-time exposures

- Missed opportunities to hedge at favorable rates

- Dependence on bank-provided spreads with limited negotiation

This lack of structure relegates forex to the realm of firefighting rather than financial strategy—leaving businesses exposed to avoidable losses and unpredictable cash flows.

Currency Volatility: The Silent Margin Killer

Currency markets are inherently volatile. For exporters and importers, even a 1-2% swing in the exchange rate can translate into significant gains or losses depending on the contract size and tenor. Yet, the true cost of ignoring this volatility often remains hidden until year-end reports reveal thinning margins.

Key Areas Impacted:

- Pricing: Without rate visibility, product pricing may not reflect actual forex costs, leading to under-quoted tenders or uncompetitive bids.

- Procurement: Importers often overlook how fluctuations affect landed costs, which can cause budget overruns and supply chain issues.

- Receivables: Exporters may find themselves collecting less than invoiced amounts if the rupee appreciates, particularly when not hedged.

For example, if an exporter bills $100,000 expecting a USDINR rate of 86, but the rate falls to 84 by the time they convert, they lose ₹2 lakh simply due to timing.

Hidden Bank Spreads: The Unseen Expense

One of the most unrecognized costs in forex transactions is the hidden spread—the difference between the rate at which a bank buys/sells a currency and the rate it passes on to the customer. These micro-margins, often as high as 1-2%, can add up dramatically over time.

Many businesses don’t realize they’re overpaying simply because they lack access to live interbank rates and have no independent advisory support. For instance, losing ₹0.50 per dollar on a $200,000 transaction leads to a straight loss of ₹1 lakh.

Opportunity Costs: What You're Missing by Doing Nothing

Inaction in forex doesn’t just result in passive losses—it causes missed opportunities:

Let’s say an importer waits too long and ends up booking at 86.25 when they could’ve locked in a forward rate at 85.50—a difference of ₹0.75. On €100,000, this translates to ₹75,000 lost—purely due to hesitation.

Term Loan Blind Spots: The FCTL Conundrum

Foreign Currency Term Loans (FCTLs) are attractive due to their lower interest rates. However, ignoring the impact of EURINR or USDINR volatility can flip a benefit into a burden.

Example:

- FCTL at 5.25% (vs. INR loan at 8.5%) offers 3.25% interest advantage.

- But if EURINR moves from 98 to beyond 106.16, currency losses start outweighing interest savings.

- A smart borrower hedges this exposure with a layered strategy—protecting both principal and interest.

How Myforexeye Turns Forex into a Strategic Advantage

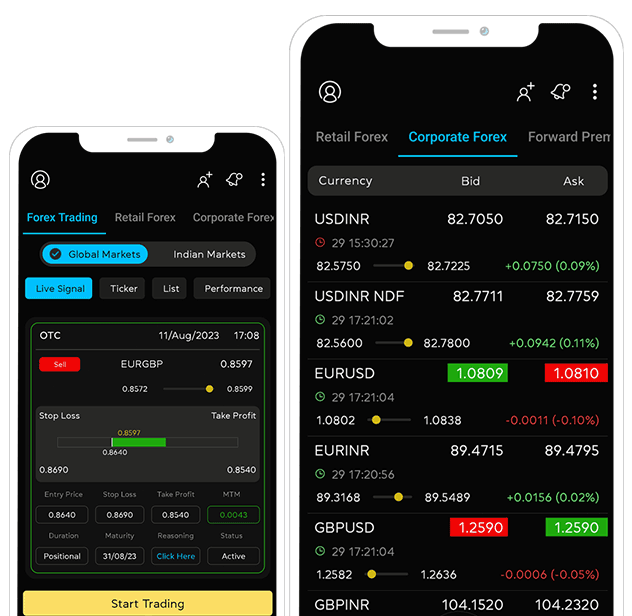

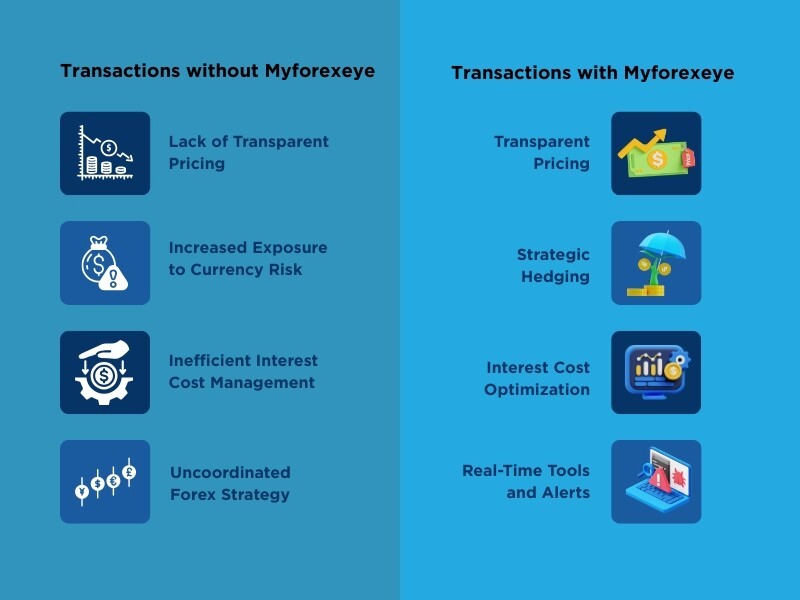

Companies that transition from reactive to proactive forex management unlock tangible financial benefits. This is where Myforexeye comes in—offering a comprehensive suite of services tailored to exporters and importers:

- Transparent Pricing:

- Benchmarking and negotiation support ensures best-in-class exchange rates—cutting hidden bank costs.

- Strategic Hedging:

- Customized risk management using forward contracts, options, and other instruments that align with trade cycles and business goals.

- Interest Cost Optimization:

- Advisory on foreign currency loans that sync with receivables to minimize interest burden and improve liquidity.

- Real-Time Tools and Alerts:

- Mobile platform for booking rates, tracking exposure, and receiving market insights—empowering businesses to act at the right moment.

Understanding the Real Loss: Forward Premium Decay

One major blind spot in forex performance evaluation is the loss of forward premium, especially when companies track only spot rates. Businesses often ignore the premium decay over the trade cycle, which distorts their perception of real gains or losses.Example:

Let’s say a company has a trade cycle of 180 days (6 months) and chooses not to hedge. The forward premium for that period is 1.80%. If the company only compares the spot rate at the time of order with the spot rate at maturity, they overlook the premium they could’ve locked in.

For instance:

- Order Date Spot Rate: 85.00

- 6-month Forward Premium: 1.80% → Forward Rate = 85 + 1.5 = 86.50

- Maturity Spot Rate: 85.90

❌ Realization if not hedged: 85.90

Loss = ₹0.60 per unit, purely from ignoring the available forward premium.

This is why businesses should calculate the First Day Forward Rate (FDFR) and use it as the benchmark.

First Day Forward Rate (FDFR) Methodology

FDFR = Spot Rate (Order Date) + Forward Premium (till maturity)

Importance: It creates an objective benchmark that moves hedging from intuition to strategy. Decisions are then based on whether the forward rate available today is better or worse than FDFR—not just spot movements.

For Exporters: Hedge when forward rate > FDFR

For Importers: Hedge when forward rate < FDFR

Using the FDFR approach ensures you make data-backed hedging decisions that protect margins.

Conclusion

The cost of ignoring forex is not always visible—but it is always real. Unmanaged exposure, hidden spreads, and missed strategic opportunities silently eat into margins. In today's volatile global trade environment, a reactive forex approach is no longer viable.

Frequently Asked Questions (FAQs)

Q1: Why is forex often overlooked by mid-sized businesses?

It’s commonly viewed as a routine function handled by banks or finance staff. The strategic implications—such as cost savings, margin impact, and planning—are underestimated.

Q2: What’s the biggest risk of not hedging currency exposure?

Sudden currency movements can drastically affect receivables and payables, leading to unanticipated losses and disrupted cash flows.

Q3: How do hidden bank spreads affect profitability?

Even a small difference in quoted vs. interbank rate (e.g., ₹0.50 on $100,000) equals ₹50,000 lost. Without benchmarking, such losses go unnoticed.

Q4: Can Myforexeye help small and medium enterprises (SMEs)?

Absolutely. SMEs gain from better rates, reduced interest costs, and simplified execution—without needing a large treasury team.

Q5: What tools does Myforexeye provide for decision-making?

Rate alert systems, market insights, cash flow planning tools, and digital dashboards for real-time tracking and execution.