Doing Nothing Is a Strategy Too—and It’s the Most Expensive One

As someone who has navigated the foreign exchange (FX) market for over 2.5 decades, we’ve seen firsthand how businesses manage or mismanage their currency exposures. And let us tell you, the most common and often most expensive "strategy" isn't a strategy at all: it's doing nothing. In the dynamic world of FX, inaction is still a decision, and it comes with real, tangible financial consequences.

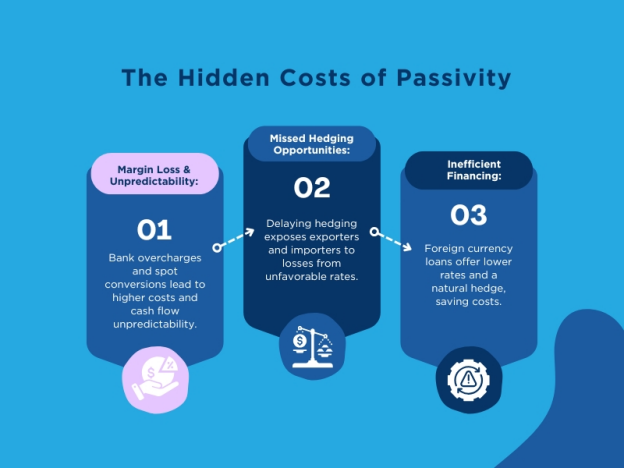

The Hidden Costs of Passivity: Why "Hoping for the Best" Fails

Many importers and exporters fall into the trap of passive FX management. This often means relying solely on their banks for conversions or simply accepting spot rates when transactions occur. But what does this cost you? A lot, as it turns out.

Margin Loss and Unpredictability:

When you passively rely on your bank, you're often paying more than you should. Banks typically overcharge on FX rates, sometimes by as much as 2-3 paise, even when clients are trying to be vigilant. This might sound small, but it adds up quickly, especially with large transaction volumes. Imagine converting $1 million; even a 0.25% fee can be significant.

Furthermore, relying on spot conversions means you're at the mercy of market fluctuations. You lose predictability in your cash flows because the rate you get today might be vastly different from what you budgeted for, directly impacting your profitability.

The High Price of Missed Opportunities (Hedging Windows):

Hedging is about securing a future exchange rate today. When you "do nothing," you miss crucial opportunities to lock in favorable rates. This is especially true for:

- Exporters: If you're an exporter expecting foreign currency payments, a weaker foreign currency against your local currency means you'll receive less of your local currency when the payment arrives. Delaying a hedge, hoping for a "better rate," can lead to quantifiable losses, like losing out on valuable forward premiums.

- Importers: For importers, a strengthening foreign currency means you'll pay more of your local currency to acquire the foreign currency needed for payments. Missing a hedging window when the foreign currency is weaker means higher costs for your imports.

Think of it like this: if you have a target exchange rate that protects your profit margin, waiting around for that rate to miraculously appear or just letting the market decide is a gamble. And in business, gambles with your bottom line are rarely a good idea.

The Cost of Inefficient Financing:

Your choice of financing for international trade also plays a huge role. Many businesses might stick to traditional INR loans without exploring foreign currency options. For instance, an exporter with USD receivables might benefit from a foreign currency-denominated loan (like PCFC or FCTL) due to potentially lower interest rates and a natural hedge against currency risk. By not actively comparing options, you could be paying significantly higher borrowing costs. The "all-in cost" (interest rate, fees, and hedging costs) is what truly matters, not just the headline interest rate.

The Power of Proactive FX Management: Outperforming the Competition

We've witnessed numerous companies transform their financial health by moving from a reactive to a proactive FX strategy. Companies that adopt structured FX strategies consistently outperform their peers in similar markets.

How do they do it?

- Structured Hedging Policies: They implement clear risk management and hedging policies. Instead of guessing, they use benchmarks like the First Day Forward Rate (FDFR) to evaluate their hedging decisions objectively. This shifts the focus from hoping for a better rate to comparing potential hedge rates against a calculated, realistic initial market expectation.

- Dynamic Decision-Making: They don't make a static choice for financing or hedging. They dynamically assess market conditions, interest rates, and currency volatility to choose the most cost-effective options between, for example, PCFC and PCINR

- Leveraging Technology and Expertise: Successful companies use integrated Management Information Systems (MIS) to gain real-time visibility into their FX exposures, hedging positions, and financing costs. They also leverage expert advisory services to develop tailored hedging policies and optimize their treasury processes. This allows them to make data-driven decisions, turning complex financial data into actionable insights.

For example, by converting non-fund based limits into fund-based limits and leveraging arbitrage opportunities (where the yield on capital employed is higher than the effective borrowing cost), companies can generate significant profits. Even a conservative estimate shows potential annual savings of crores of rupees by optimizing borrowing costs and hedging strategies.

Stop "Doing Nothing" and Start Acting

The message is simple: in the world of foreign exchange, "doing nothing" is a strategy, but it’s the most expensive one you can choose. It leaves your business vulnerable to market volatility, eats into your profit margins, and limits your growth potential.

It's time to move from passive reaction to active planning. Embrace structured FX strategies, leverage technology, and seek expert guidance. By proactively managing your FX exposure, you can protect your profits, enhance your liquidity, and gain a significant competitive edge in the global marketplace. Don't let inaction be the costliest decision your business makes.

FAQ (Frequently Asked Questions)

Q1: What does "working capital management" mean in simple terms?

Working capital management is essentially managing the day-to-day money a business uses for its operations. It's the difference between what you own (like cash, money owed to you, and inventory) and what you owe short-term (like bills to suppliers and short-term debts). Good management means you have enough cash to run your business smoothly and take advantage of growth opportunities.

Q2: Why is "doing nothing" in FX management so expensive?

When you do nothing, you're essentially letting the market decide your exchange rates. This can lead to:

- Higher costs: Banks might give you less favourable rates, costing you more on conversions.

- Unpredictable profits: If the currency moves against you, your planned profits can shrink or even turn into losses.

- Missed opportunities: You lose chances to lock in good rates when the market is favourable, which is what hedging is all about.

Q3: What are "hedging windows" and why are they important?

Hedging windows are periods when you can lock in a favourable exchange rate for a future transaction using tools like forward contracts. They're important because currency rates are always moving. If you wait, you might miss the chance to secure a rate that protects your profit margin or minimizes your costs.

Q4: How can businesses move from "doing nothing" to active FX management?

Here are a few key steps:

- Understand your exposure: Know exactly how much foreign currency you're dealing with for imports and exports.

- Set benchmarks: Use tools like the First Day Forward Rate (FDFR) to know what a good rate for your transaction should be.

- Explore financing options: Compare different loan types (like foreign currency loans vs. local currency loans) to find the cheapest "all-in cost".

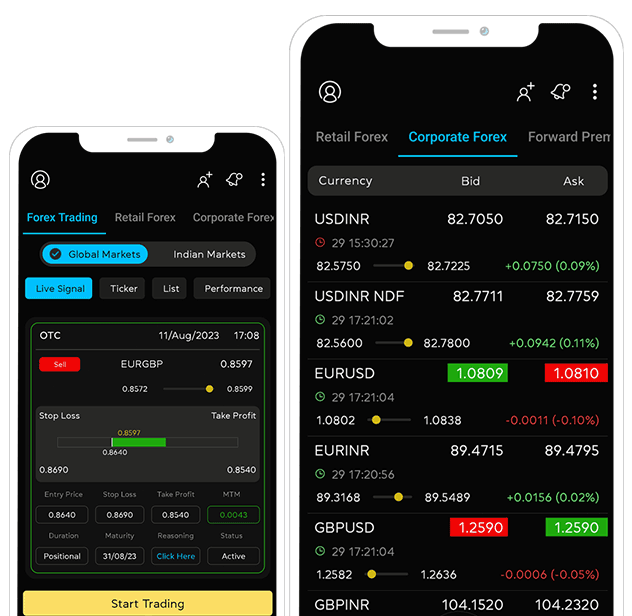

- Use technology: Platforms like Myforexeye’s App can give you real-time rates and help you track your exposures and hedges.

- Seek expert advice: Get help from specialists who understand the market and can tailor strategies for your business.

Q5: What is the "First Day Forward Rate (FDFR)" methodology?

The First Day Forward Rate (FDFR) is a way to set a benchmark for your hedging. It's calculated by taking the spot rate (current rate) on the day you get an order and adding the forward premium (a reflection of interest rate differences) until the expected payment date. This gives you an objective target rate to aim for when you're hedging, helping you evaluate if your hedging decisions are truly beneficial.