The Hidden Costs of Foreign Currency Loans for Working Capital or Term Loans

Foreign currency loans are often marketed as cost-saving tools for businesses that deal internationally. With interest rates abroad being much lower than domestic rates, these loans—whether for working capital or as Foreign Currency Term Loans look appealing at first glance. But like many things in finance, what you see isn't always what you get.

Let’s uncover the hidden costs involved and see how numbers can change the narrative.

Why Foreign Currency Loans Seem Attractive

Imagine you are an Indian company. You compare loan rates:

Now let’s say you borrow ₹10 crore in Euros at EURINR = 98. Over 2.5 years, this interest advantage should save you approximately ₹81.25 lakhs (3.25% x 2.5 years x ₹10 crore).

But that’s not the full picture.

Hidden Cost #1: Currency Risk

Foreign currency loans expose you to exchange rate volatility. Let’s revisit the same ₹10 crore loan. You borrowed at EURINR = ₹98. Now consider 3 repayment scenarios:

- Below ₹98: Good news — You repay fewer INR

- Between ₹98 - 106.16: Mixed—Interest savings offset FX losses

- Above ₹106.16: Bad news — Currency loss wipes out savings

Example:

If EURINR rises to 110, the repayment cost becomes:

₹10 crore ÷ ₹98 × ₹110 = ₹11.22 crore

That’s a loss of ₹1.22 crore—far more than the ₹81.25 lakh interest saved!

Hidden Cost #2: Hedging Expenses

To avoid currency risk, you may hedge using a forward contract. But hedging isn’t free.

If the forward premium for EURINR is 3% per year, for a 2.5-year loan, this adds up to:

₹10 crore × 3% × 2.5 = ₹75 lakhs

Now your net savings shrink to just ₹6.25 lakhs (₹81.25 lakhs - ₹75 lakhs).

Hidden Cost #3: Benchmark Rate Volatility

Foreign loans are often linked to global benchmark rates like SOFR (USD), EURIBOR (EUR), TONA (JPY).

If SOFR rises from 1% to 4%, a $1 million USD loan interest jumps from 3% to 6%, an extra $30,000 (or ₹25 lakh approx.) annually.

Hidden Cost #4: Administrative Charges

Foreign loans bring extra operational costs like:

- Foreign remittance fees

- Bank processing charges

- Loan management overheads

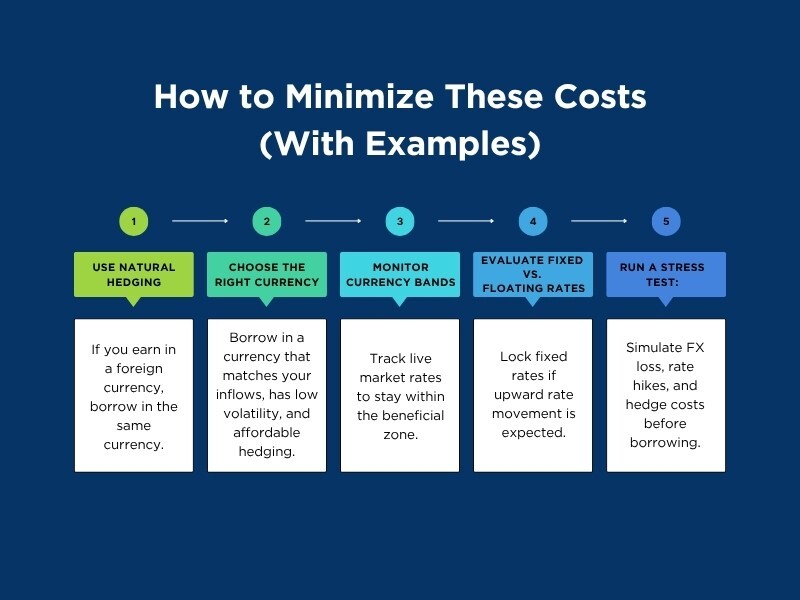

How to Minimize These Costs (With Examples)

Key Takeaways

- FX Movement: Can nullify interest savings

- Hedging: Reduces risk but adds cost

- Interest Rate Benchmark: Rising rates can inflate payments

- Admin Fees: Add operational expense

- Natural Hedge: Offers best protection without cost

Conclusion

Foreign currency loans look cheaper on paper, but the reality is layered. Currency fluctuations, hedging costs, interest volatility, and charges can quietly eat into your savings. Think in numbers, not just interest rates.

A loan that seems 3% cheaper could end up 10% costlier if not carefully planned.

If your business deals in exports or imports, consult with a forex advisor who can help you run the math, hedge smartly, and turn foreign borrowing into a real competitive advantage—not a hidden trap.

FAQ (Frequently Asked Questions)

1. How does currency depreciation affect foreign currency loans?

Currency depreciation increases the local currency cost of repayments. For example, if INR depreciates 10% against EUR, a €1 million loan becomes ₹1.1 crore instead of ₹1 crore (assuming EURINR was 100 initially).

2. What is natural hedging and how does it help?

Natural hedging means borrowing in the same currency you earn. If you export in USD or EUR, taking a loan in the same currency ensures your inflow matches the outflow—minimizing FX risk.

3. What are the risks of floating interest rates on foreign loans?

Floating rates depend on global benchmarks like SOFR or EURIBOR. If these rise, your interest payments also rise, potentially erasing any cost advantage of taking a foreign currency loan.

4. How expensive is it to hedge a foreign currency loan?

Hedging costs depend on currency volatility and tenure. For example, a 2.5-year EURINR hedge with a 3% annual premium could cost ₹75 lakhs on a ₹10 crore loan.

5. When does a foreign currency loan stop being cost-effective?

If the domestic currency weakens too much, the gain from lower interest is wiped out. In one example, a EURINR rise above 106.16 on a loan taken at 98 makes the loan more expensive than a regular INR loan.