The Mathematics Behind Forex Conversion – Explained

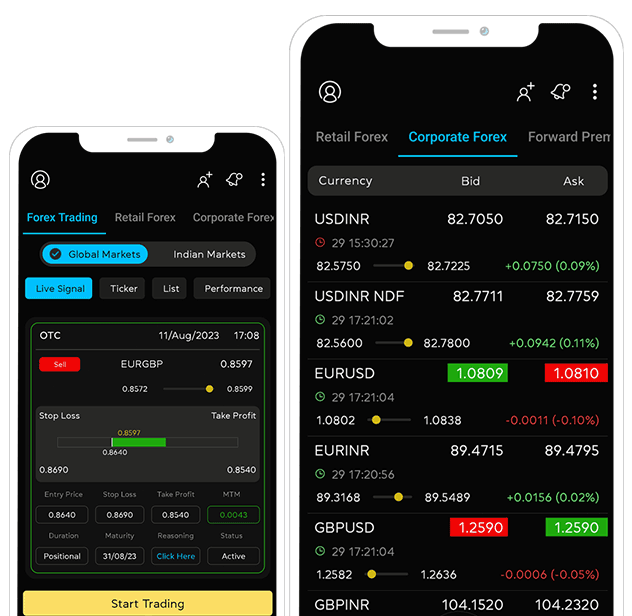

Foreign exchange transactions can feel complex, but at its core, it's driven by simple mathematics. Whether you're an importer locking in costs or an exporter protecting revenue, understanding the basic calculations behind Cash, Tom, Spot, Forwards, Forward Cancellations, Early Deliveries, Cross Currency rates, and bank margins can empower you to make smarter financial decisions. This blog will explain these concepts using clear examples and definitions along the way.

Cash, Tom, and Spot Transactions

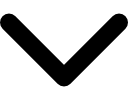

Forex transactions are categorized based on settlement timelines:

- Cash (T): Same-day settlement. Useful for immediate needs.

- Tom (T+1): Settlement occurs the next business day.

- Spot (T+2): Most common, settled two business days after trade.

Example:

Spot rate = ₹83.50/USDCash Spot Premium = ₹0.03

Tom Next Premium = ₹0.01

Bank Margin = ₹0.02

Formulas:

Bank Margin

-

Importer's Perspective: Bank margin is the additional fee or percentage a bank adds to the exchange rate, increasing the cost of converting local currency to foreign currency for payments.

-

Exporter's Perspective: Bank margin is the markup a bank deducts from the exchange rate, reducing the local currency received when converting foreign earnings.

Understanding the Spot Rate

The Spot Rate reflects current market conditions. Banks quote:

- Bid Rate

- Ask Rate

Forward Contracts – Planning Ahead

Forward contracts let you fix an exchange rate for a future date, hedging against volatility.

Forward Rate = Spot Rate + Premium (or Discount) ± Bank Margin

Example: Spot = ₹83.50, Premium = ₹0.80, BM = ₹0.02 → Forward Rate = ₹84.32

Two Types:

- Fixed Date Forward: Exact date settlement.

- Window Forward: Flexible date range for settlement.

Forward Cancellations and Early Deliveries

Forward Cancellation: You cancel the contract before maturity. Bank recalculates the rate.

Early Delivery: You settle early, and the bank adjusts for unearned premium.

Example: Original Forward = ₹84.50, Spot = ₹83.90 → Loss = ₹0.60 per dollar

First Day Forward Rate (FDFR) – Smart Benchmarking

FDFR = Spot Rate + Forward Premium

Example: Spot = ₹97 (EURINR), Premium = ₹2.15 → FDFR = ₹99.15

Exporters: Hedge when forward > FDFR

Importers: Hedge when forward < FDFR

This benchmark helps avoid emotional decisions and ensures rates are booked based on data.

Cross-Currency Conversions

When dealing with currencies like EUR/JPY or GBP/AUD, banks use USD as a bridge:

Formula: EURJPY = EURUSD × USDJPY

Example: EURUSD = 1.10, USDJPY = 150 → EURJPY = 165.00

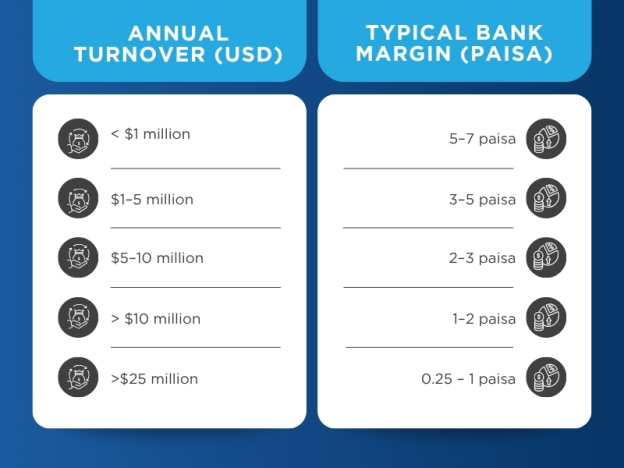

Bank Margins and Turnover Matrix

Banks charge different margins based on your transaction size:

Typical Margin Table:

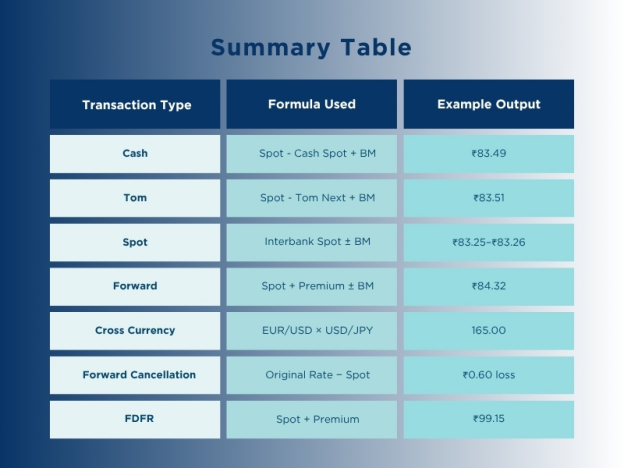

Summary Table

Conclusion: Know the Math, Control the Outcome

Understanding the logic and formulas behind forex rates allows you to better manage currency exposure. From cash and spot to forwards and cancellations, every transaction can be evaluated through basic arithmetic, reducing hidden costs and optimising timing. Use data, not guesswork, to navigate global currencies confidently.

FAQ (Frequently Asked Questions)

1. What is the difference between Cash, Tom, and Spot transactions?

Cash is same-day settlement (T), Tom is next business day (T+1), and Spot is two business days (T+2).

2. When should I use a Window Forward instead of a Fixed Date Forward?

- When should I use a Window Forward instead of a Fixed Date Forward?

3. What happens if I cancel a forward contract early?

The bank recalculates the rate based on current market conditions. You may face a cost or gain depending on the rate movement.

4. What is FDFR and why is it important?

FDFR (First Day Forward Rate) is a benchmark calculated using Spot + Forward Premium. It helps you decide the best time to hedge.

5. How do bank margins affect my forex transaction costs?

Banks add margins over interbank rates. A higher margin increases your cost or reduces your revenue, depending on the direction of trade.