Dynamic Use Cases of Various Working Capital Products for Exports and Imports

Running an import-export business involves managing money that flows in and out while dealing with foreign clients and suppliers. To manage this well, you need working capital—the money used for daily operations. Choosing the right tool for financing is not easy because costs, exchange rates, and loan terms keep changing. This blog will explain the most common working capital options with simple examples and show why selecting the right one is often tricky.

Understanding the Trade Cycle

The trade cycle is the time between spending money to buy goods or materials and receiving payment from customers. For example, if it takes 30 days to get goods, 15 days to manufacture, 20 days to sell, and 45 days for the customer to pay, then the total cycle is 110 days. This is how long you need financing for.

Inventory Days (30) + Production Days (15) + Receivable Days (45) – Payable Days (say 10) = 80 days of working capital requirement.

This helps you decide which product suits your timeline and cost.

Working Capital Products for Exporters

|

Product |

Description |

When to Use |

Key Benefits |

Interest% |

|

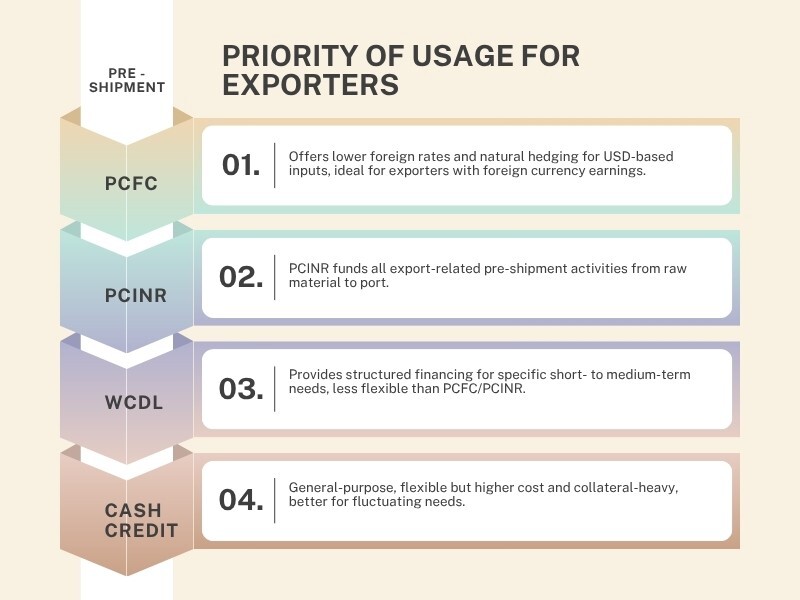

Cash Credit (CC) |

A revolving credit facility allowing funds up to a limit against collateral (e.g., inventory, receivables). |

For short-term operational expenses or fluctuating cash flow needs. |

Flexible withdrawals, supports daily operations. |

8-11% |

|

Working Capital Demand Loan (WCDL) |

A term loan for specific working capital needs, repaid in installments. |

For short- to medium-term projects or gaps. |

Structured repayments, predictable costs. |

7-8.5% |

|

PCFC |

A foreign currency loan (e.g., USD, EUR) from order confirmation to shipment. |

To fund raw material imports or leverage lower foreign interest rates, creating a natural hedge. |

Reduces currency risk, potentially lower rates. |

SOFR + (1 - 2.5%) |

|

PCINR |

A loan in Indian Rupees from order to shipment. |

When input costs are in INR or domestic rates are favorable. |

Avoids FX risk, simpler for INR-based costs. |

8-10% |

|

Export Factoring |

Selling foreign receivables to a factor at a discount for immediate cash. |

To improve cash flow, reduce credit risk, and outsource collections. |

Fast liquidity, risk mitigation with non-recourse options. |

SOFR + (4% - 6%) |

|

Bill Discounting |

Selling export receivables to a bank at a discount for immediate funds. |

To bridge liquidity gaps between shipment and payment. |

Quick cash |

1-3% discount fee |

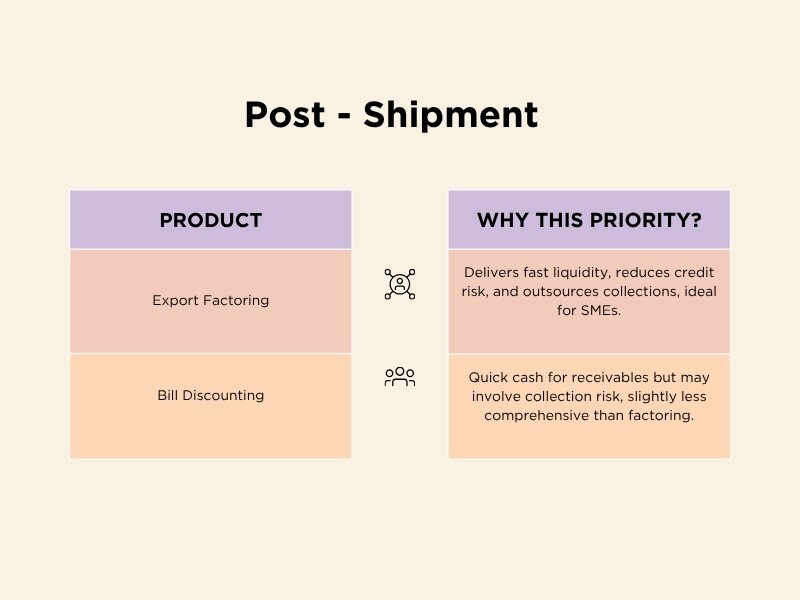

Priority of Usage for Exporters

Post-Shipment

Working Capital Products for Importers

|

Product |

Description |

When to Use |

Key Benefits |

Interest% |

|

Buyer's Credit |

A loan from the exporter’s country to pay the supplier, facilitated by the importer’s bank. |

For unfavourable exchange rates and lower interest costs |

Access to lower foreign rates (e.g., SOFR), extended payment terms. |

SOFR + (0.5% -2%) |

|

Supplier's Credit |

Credit extended by the exporter, allowing deferred payment post-delivery. |

To secure competitive payment terms and improve cash flow. |

Simplifies financing, but assesses implicit costs in pricing. |

SOFR + (0.5 - 2%) |

|

Cash Credit (CC) |

A revolving credit facility against collateral. |

For short-term operational needs or fluctuating cash flows. |

Flexible access to funds, supports routine payments. |

8-11% |

|

Working Capital Demand Loan (WCDL) |

A term loan repaid in installments. |

For specific short- to medium-term gaps or projects. |

Predictable repayment schedule. |

7-8.5% |

|

Foreign Currency Term Loan (FCDL) |

A loan in foreign currency (e.g., USD, EUR) for long-term investments. |

For machinery, technology upgrades, or expansions with stable FX expenses. |

Leverages lower foreign rates, aligns with FX earnings. |

SOFR + 3%-5% |

Priority of Usage for Importers

Why Is It Difficult to Choose the Right Tool?

Why Is It Difficult to Choose the Right Tool?

- Currency Fluctuations

USDINR today is 84, but if it moves to 86 in 3 months, your repayment increases by ₹2 per dollar.

For $100,000, that’s ₹2,00,000 extra cost. - Interest Rate Changes

- Trade Cycle Mismatch

If your buyer pays in 45 days but you borrow for 90, you pay interest unnecessarily. - Mixed Cost Structures

A loan may look cheap, but include processing fees, collateral costs, and hedging—total cost rises.

Simple Use Case Comparison

You’re an importer buying goods worth $100,000 from Germany.

Option 1: Supplier’s Credit at $105,000, payable in 180 days.

Option 2: Buyer’s Credit at 6.5% on $100,000 → interest = $3,250, total = $103,250

The Buyer’s Credit is $1,750 cheaper. But only if INR stays stable. If INR weakens from 84 to 86:

Extra cost = $100,000 × ₹2 = ₹2,00,000

So even if the loan is cheaper in dollars, currency risk makes it costlier in INR unless you hedge.

How Currency Market Volatility Affects Choices

Suppose you export and your input cost is in INR, but you borrow in USD using PCFC.

If USD weakens from 85 to 84, your rupee repayment rises.

Better to borrow in INR using PCINR in such cases. But if you earn in USD and input cost is also in USD, PCFC gives natural hedge.

Conclusion

Every financing tool has pros and cons. Exporters and importers must match tools to their cash flow cycle and currency exposure. The right choice depends on your payment timelines, cost sensitivity, and risk appetite. Always calculate the all-inclusive cost and consider currency fluctuations.

FAQ (Frequently Asked Questions)

1. What is working capital?

It’s the money used to run daily operations like paying for goods or salaries.

2. Which loan is best for exporters?

If you earn in USD and your cost is also in USD, PCFC is best due to lower rates and no FX risk.

3. Why is Supplier’s Credit risky?

Because the supplier may add extra cost into product price.

4. How to decide loan tenure?

Match it with your trade cycle, not more or less.

5. What is a natural hedge?

When both your income and repayment are in the same currency, reducing FX risk.