Let Your Investment Grow With Myforexeye

We use systematic strategies using quantitative and computational methods refined over 15 years of research and trading. Our approach focuses on analysis and scientific research, supported by strong infrastructure, as the core of our successful wealth management strategy.

Why You Need Wealth Management?

Wealth management is crucial for ensuring financial stability and maximizing investment return by achieving long term goals. It provides peace of mind and financial independence.Here’s why you should consider wealth management:

Wealth Management with Myforexeye?

At Myforexeye, we are committed to providing a comprehensive platform and

personalized service

that caters the needs of every traders and investors. Here’s why you choose

to partner with us:

Expertise and Insight

We offer timely market analysis, expert insights, and research reports to help you make informed decision making.

Personalized Strategies

We prioritize solutions to your complex financial problems backed by extensive research and data.

Reliable Partner

Myforexeye stands out as a reliable partner in investment with its profound expertise and experienced team dedicated in providing valuable insights on wealth management.

Risk Management Solutions

We offer comprehensive risk management solutions and strategies designed to protect your investments and optimize your financial outcomes.

Global Market Exposure

Equity markets provide access to a diverse range of industries and geographical regions. By investing globally, you can capitalize on international economic trends and sector-specific growth opportunities.

Product Offering

Debt Management

Our strong network of major debt market participants across banks, and our team of professionals handle and organize debts effectively to improve your financial stability. It involves creating a strategy to repay debts, often with the help of financial experts or agencies, to reduce interest rates, consolidate payments, and ultimately lower your debt.

Equity

We construct a diversified portfolio of stocks across Asset Management Companies (AMCs), managed by experienced professionals. Our focus is on capital appreciation opportunities across various market caps, sectors, and themes, aligned with SEBI categorizations.

Commodity

Our approach to commodity leverages a robust network within key commodity markets, facilitated by marketanalysts. We focus on optimizing exposure across diverse commodities, aiming for strategic gains aligned with market trends and regulatory frameworks.

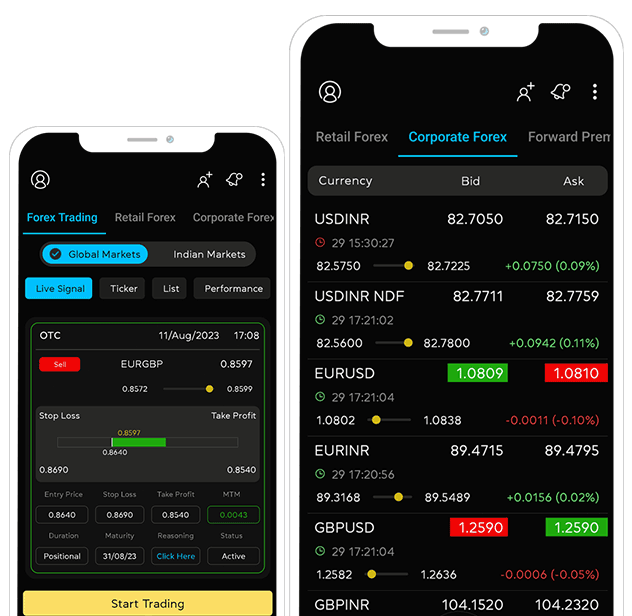

Forex

Our approach to managing Forex involves leveraging a strong network within global currency markets, guided by analysts. We focus on optimizing currency exchange opportunities, employing strategies that align with market dynamics and regulatory guidelines to achieve favorable outcomes.

World of Investment Opportunities

Committed To Our Strategy

Balance Growth of Mid/Small Market Caps

Supporting the steady growth of mid and small-sized market companies, ensuring a well-balanced and practical approach for sustainable development in the market.

Dynamic Equity Portfolio Construction

Crafting a flexible and responsive investment portfolio, adapting to market changes with dynamic equity portfolio construction for optimal performance and adaptability.

Flexible Allocation for Diverse Return

Optimize returns with a versatile investment strategy, allowing for flexible allocation that caters to diverse market conditions and ensures a well-rounded approach to achieving financial goals.

Frequently Asked Questions

What We Have Achieved Till Now

Total Transactions

Transactions Processed

Total Savings

No. of Clients Served